Ever wondered how some traders consistently profit from predictable market events? Reverse split arbitrage is one of Wall Street's best-kept secrets - a strategy that turns corporate actions into consistent profits.

What is Reverse Split Arbitrage?

Reverse split arbitrage exploits a specific corporate action inefficiency. When companies execute reverse stock splits, they must cash out fractional shares that cannot be converted to whole shares. By strategically purchasing minimal positions before the split, traders receive cash settlements at the post-split price, creating a mathematically predictable profit opportunity with defined risk parameters.

How the Strategy Actually Works

Here's the simple process that makes reverse split arbitrage so profitable:

1️⃣ Buy Before Split

Purchase 1 share of a stock before the reverse split happens (usually around $0.32 or similar low price).

2️⃣ Split Occurs

The company executes the reverse split. Your fractional share gets converted to cash at the new price.

3️⃣ Receive Cash

After about 2 weeks, you receive the cash equivalent (like $3.20) directly in your account.

💰 Keep Profit

The difference between what you paid and what you receive is pure profit - it's that simple.

How to Scale This Strategy

The key to maximizing profits from reverse split arbitrage is scaling up your operation:

🏦 Multiple Accounts

Create additional brokerage accounts to increase your buying power and multiply your profits per opportunity.

🎯 Single Share Strategy

Usually you only buy 1 share per account (unless there's a rare round lot opportunity - basically hitting the lottery).

⏰ 2-Week Settlement

After the split, it takes about 2 weeks for the cash to be issued and hit your account.

📈 Compound Growth

With more accounts, each reverse split opportunity becomes more profitable as you scale across multiple positions.

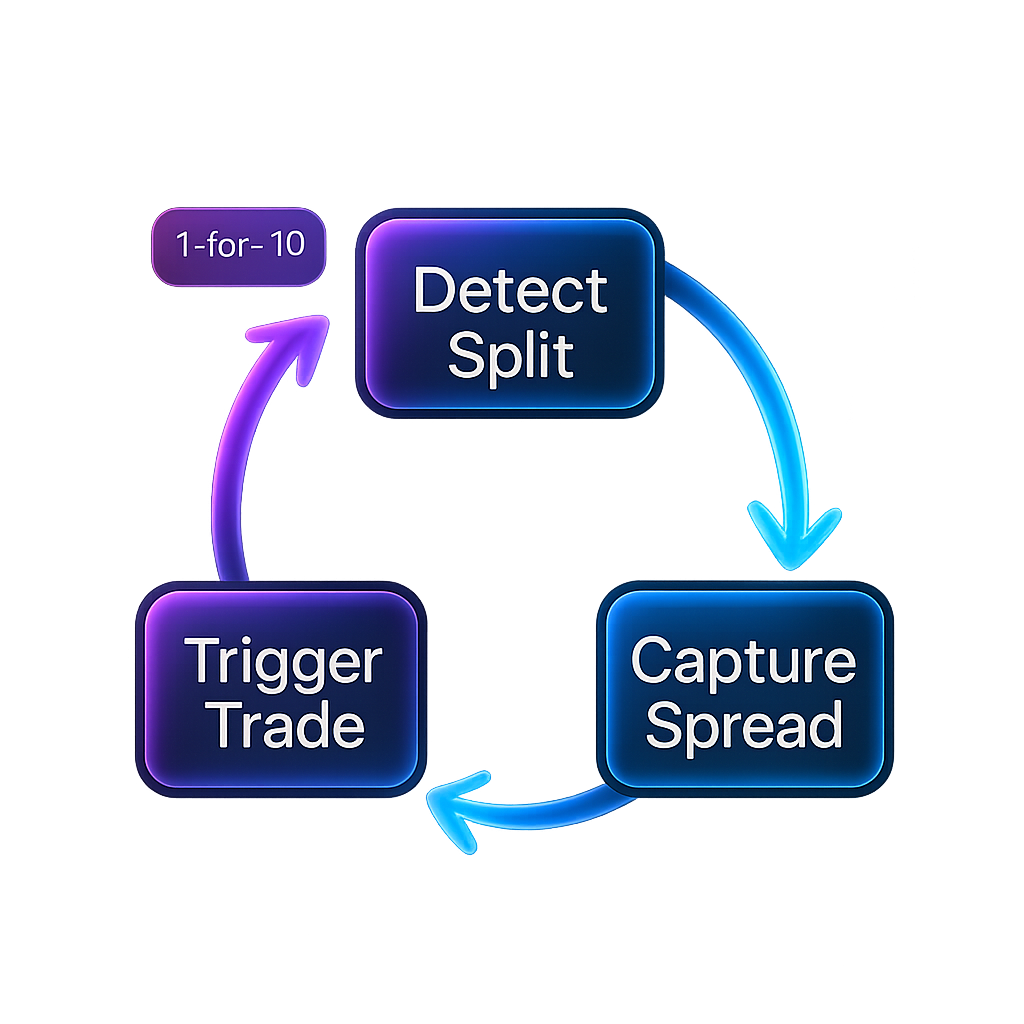

How TradeLabs Automates Everything

Instead of manually watching for reverse splits and executing trades yourself, TradeLabs handles the entire process automatically:

🤖 Real-Time Detection

Our bot constantly monitors for reverse splits happening in real time across all markets.

📡 Instant Alerts

When a reverse split is detected, the bot immediately pings all connected trading bots with the opportunity.

💸 Automatic Purchase

The bots automatically purchase the reverse split positions across all your connected accounts.

💰 Profit Collection

After 2 weeks, the cash hits your accounts automatically - you just collect the profits.

Ready to Start Earning from Reverse Split Arbitrage?

Join thousands of traders already profiting from automated reverse split arbitrage. Our curated signals and lightning-fast execution give you the edge you need.

Start Your Free TrialCommon Questions About Reverse Split Arbitrage

Here are the most frequently asked questions about this profitable trading strategy:

❓ Is reverse split arbitrage legal?

Yes, reverse split arbitrage is completely legal. It's a legitimate trading strategy that takes advantage of corporate actions and broker settlement procedures. Many institutional traders use this strategy regularly.

❓ How much money can you make with reverse split arbitrage?

Profits typically range from $2-8 per share per opportunity, depending on the split ratio and stock price. With multiple brokerage accounts and consistent opportunities, many traders earn $500-2000 per month from reverse split arbitrage.

❓ What are the risks of reverse split arbitrage?

The main risks include split cancellation (rare), broker technical issues, and opportunity costs. Since you typically only invest $0.30-1.00 per position, the maximum loss per trade is minimal, making this a low-risk strategy.

❓ How often do reverse split opportunities occur?

Reverse split opportunities typically occur 2-5 times per month across all markets. TradeLabs monitors thousands of stocks continuously to identify these opportunities as soon as they're announced, giving you maximum time to position.

❓ Which brokers work best for reverse split arbitrage?

Most major brokers support reverse split arbitrage including Robinhood, TD Ameritrade, E*Trade, and Interactive Brokers. The key is having multiple accounts to maximize your positions per opportunity. TradeLabs supports all major brokers automatically.

Getting Started is Simple

Begin your journey with our free trial. Connect your brokerage accounts and let TradeLabs handle the rest.

Connect Your Accounts

Link your brokerage accounts to the TradeLabs platform securely.

Enable RSA Signals

Activate reverse split arbitrage automation for all connected accounts.

Bot Executes Trades

When reverse splits are detected, the bot automatically purchases positions across accounts.

Collect Profits

After 2 weeks, the cash hits your accounts automatically - you just collect the profits.

Important Risk Disclosure

While reverse split arbitrage can be highly profitable, all trading involves risk. Never invest more than you can afford to lose, and always ensure proper position sizing and risk management.

Why Traders Choose TradeLabs for RSA

TradeLabs takes all the manual work out of reverse split arbitrage. Here's what makes us different:

- Real-Time Detection: Our bots monitor splits happening across all markets 24/7

- Instant Execution: Automatic purchase across all your connected accounts when opportunities arise

- Multiple Account Support: Scale your profits by connecting multiple brokerage accounts

- Hands-Free Operation: You don't have to do anything - the system handles everything automatically

- Guaranteed Settlement: After 2 weeks, the cash hits your accounts automatically

Ready to start earning from reverse split arbitrage? Join TradeLabs today and let our automation handle the entire process while you collect the profits.